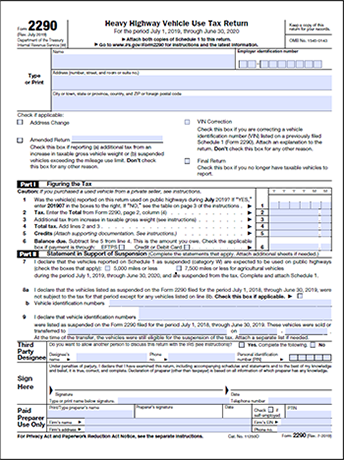

The Heavy Vehicle Use Tax

also known as the Federal Form 2290, is a tax levied by the Internal Revenue Service (IRS) on heavy vehicles weighing 55,000 pounds or more and used on public highways. The HVUT's mission is to contribute to the upkeep and improvement of the nation's highways.

HVUT

The most common vehicles subject to the HVUT are trucks, tractors, and buses used for business purposes. This includes commercial vehicles, such as those used to transport goods or passengers, as well as vehicles used for farming or logging operations.

Truck Tax 2290

Every year, the owners of heavy vehicles are required to file tax 2290 and pay the Heavy vehicle use tax. The HVUT must be filed and paid by the last day of the month following the month of Vehicle’s first use on public highways.